Attain Your Dreams with the Assistance of Loan Service Specialists

Attain Your Dreams with the Assistance of Loan Service Specialists

Blog Article

Streamline Your Financial Journey With Trusted and Reliable Finance Solutions

Relied on and reliable car loan services play a pivotal function in this process, providing people a reputable path in the direction of their economic objectives. By recognizing the benefits of working with credible lending institutions, exploring the various types of loan solutions readily available, and refining in on key aspects that determine the appropriate fit for your demands, the path to financial empowerment becomes more clear - mca direct lenders.

Benefits of Trusted Lenders

When looking for economic aid, the advantages of picking relied on lending institutions are vital for a protected and reliable borrowing experience. Relied on lending institutions use openness in their terms, giving borrowers with a clear understanding of their responsibilities. By dealing with reputable lending institutions, customers can avoid concealed charges or predative methods that can lead to financial pitfalls.

In addition, trusted loan providers commonly have actually established relationships with governing bodies, guaranteeing that they run within legal borders and comply with market requirements. This conformity not just secures the customer however additionally fosters a feeling of count on and reliability in the loaning procedure.

Furthermore, reputable loan providers prioritize customer support, supplying support and advice throughout the borrowing journey. Whether it's making clear funding terms or helping with repayment choices, trusted lenders are devoted to aiding consumers make well-informed economic decisions.

Kinds Of Funding Provider Available

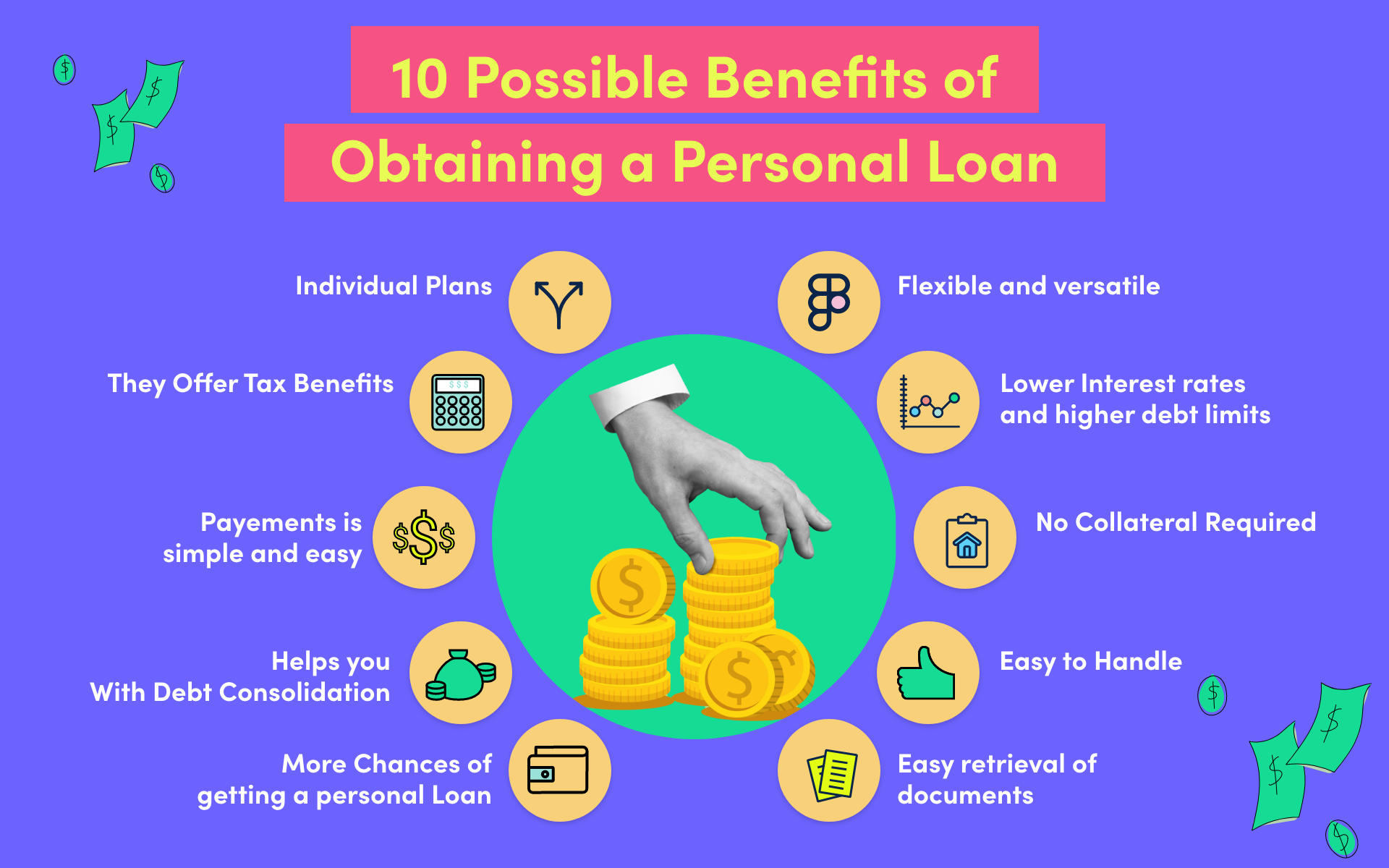

Numerous economic establishments and lending firms supply a diverse series of lending services to cater to the differing demands of borrowers. Some of the usual kinds of financing solutions offered include individual fundings, which are commonly unsafe and can be utilized for various objectives such as financial obligation combination, home restorations, or unforeseen expenditures. Home loan are particularly developed to aid individuals buy homes by providing considerable amounts of money upfront that are paid back over a prolonged period. For those seeking to buy an automobile, automobile financings supply a method to finance the purchase with repaired monthly payments. In addition, service financings are readily available for entrepreneurs looking for resources to start or expand their endeavors. Pupil loans provide to academic expenditures, supplying funds for tuition, publications, and living expenses during academic pursuits. Recognizing the different kinds of loan services can help borrowers make informed choices based upon their specific monetary demands and goals.

Factors for Choosing the Right Car Loan

Having actually acquainted oneself with the varied variety of lending solutions readily available, consumers have to read what he said thoroughly evaluate crucial variables to choose the most ideal funding for their specific monetary requirements and goals. One crucial element to take into consideration is the rate of interest price, as it directly affects the complete amount settled over the funding term. Consumers need to compare interest prices from different loan providers to secure one of the most competitive alternative. Car loan terms and conditions also play an essential role in decision-making. Comprehending the settlement timetable, fees, and penalties connected with the car loan is important to avoid any type of surprises in the future.

Moreover, consumers ought to examine their current financial scenario and future leads to figure out the financing quantity they can conveniently pay for. By carefully thinking about these elements, customers can pick the appropriate car loan that lines up with their monetary goals and abilities.

Simplifying the Funding Application Refine

Performance in the loan application process is extremely important for ensuring a smooth and expedited loaning experience - mca direct lenders. To enhance the lending application process, it is vital to provide clear assistance to applicants on the required paperwork and details. By integrating these structured processes, funding suppliers can provide a much more efficient and user-friendly experience to borrowers, ultimately enhancing overall customer complete satisfaction and loyalty.

Tips for Effective Loan Settlement

Prioritize your loan payments to avoid failing on any kind of fundings, as this can negatively affect your credit history score and financial stability. In situation of financial troubles, communicate with your loan provider to discover possible alternatives such as lending restructuring or deferment. By staying organized, proactive, and monetarily disciplined, you can successfully browse the process of repaying your fundings and achieve greater economic flexibility.

Verdict

In verdict, making use of trusted and effective lending services can significantly streamline your monetary journey. By very carefully choosing the appropriate lender and type of car loan, and improving the application process, you can guarantee an effective borrowing experience.

Report this page